A new study has been published which investigates what nicotine e-liquid strengths we use in the UK.

Cancer Research UK supported the study.

You can read the full paper here.

Introduction

As the UK government has proposed to add a tax to e-liquids based on nicotine strength this study examined what the most popular strengths were for adult vapers.

The introduction to the study echoes the thoughts of many vapers and advocates…

“However, even if they (e-liquids) remain less expensive than tobacco, taxing higher-strength nicotine e-liquids at higher rates could have unintended consequences for people who smoke and those who have switched from smoking to vaping.

Higher-strength e-liquids provide better relief from withdrawal and satisfy cravings for tobacco and may, therefore, be more effective for helping prevent relapse .

Making these products more expensive could disincentivise their use and drive vapers toward cheaper, lower-strength e-liquids.”

“It could also prompt them to source illicit higher strength products and potentially also to mix their own e-liquids, which poses potential safety risks”

They state the purpose of this study is…

“Understanding what nicotine strengths adult vapers in Great Britain are currently using, before the introduction of the Vaping Products Duty, and how this differs across subgroups of vapers, can offer insight into who will be most affected by the duty.”

Method

The data was taken from the Smoking & Alcohol Toolkit Study which began in 2006 (in England) and expanded to Wales and Scotland in October 2020.

The study was continued and monthly cross sectional household interviews (computer or telephone) were conducted with adults over 16 years old.

Around 29,400 adults were consulted per year and participants shared their nicotine & alcohol behaviour. This is reviewed monthly and shared.

The data on nicotine strength of current vapers was first collected in July 2016 and this was taken along with subsequent data up until January 2024 (which was the most recent data taken for this study).

Results

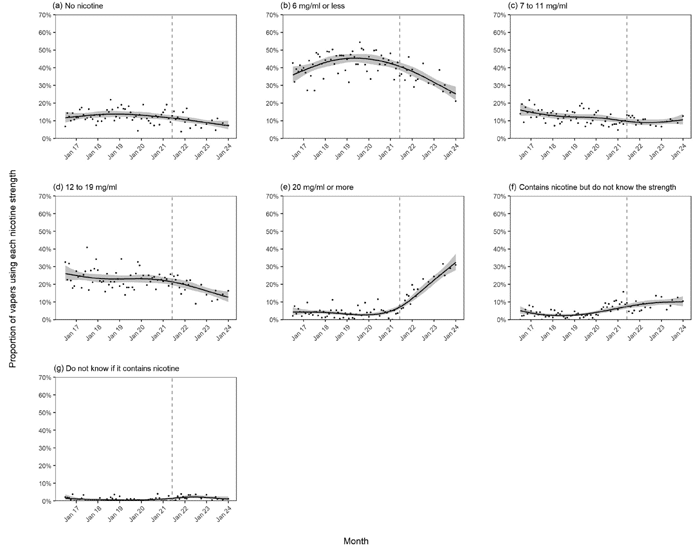

The dotted line in the following figures show the point where disposable vapes became popular in June 2021. This point to January 2024 is the main focus of this study.

Nicotine Strength

Prior to June 2021 the average participants using 20mg (or higher – before the TPD regulations) was 3.8%. In January 2024 the average was 32.5%.

In contrast the data regarding nicotine free vapes started at an average of 11.5% prior to June 2021 and decreased to 7.3% in January 2024.

For other strengths the results were as follows:

- Less than or equal to 6mg: the average figure was 40.8% around June 2021 which dropped to 25.3% in Jan 2024.

- 7-11mg: stayed stable between June 2021 to Jan 2024 at around 9.4%.

- 12-19mg: 21.4% around June 2021 to 12.7% in Jan 24.

There were also participants who did not know the nicotine strength of what they were vaping.

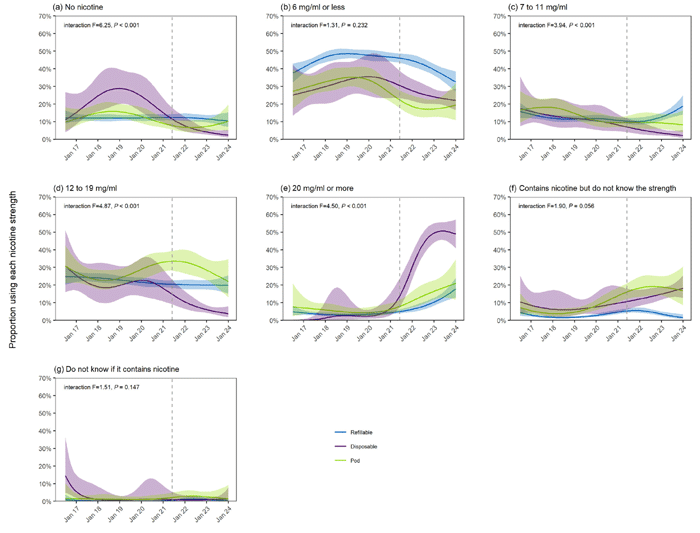

Device Type

Also these results were broken down by the type of device used:

- Refillable (any refillable and rechargeable device)

- Disposable (single use vape)

- Pod kit (a rechargeable kit which uses replaceable pre-filled pods).

The type of device also had an impact on the results.

In January 2024 49% disposable vape users recorded using 20mg nicotine strength, compared to 21% of pod kit users and 17.9% of refillable kit users.

Compare this with the figures prior to June 2021. An average of 2.6% vapers used 20mg nicotine strength with disposable vapes, 3.7% refillable vapes and 5.7% pod kits.

Conclusions

I will copy and paste from the study…

“If the duty discourages smokers from trying to quit with e-cigarettes or prompts them to use lower-strength e-liquids, it could undermine quitting and perpetuate smoking.”

“Given higher-strength e-liquids are more effective in relieving cravings for tobacco, people who want to use e-cigarettes to quit smoking could be encouraged to use higher-strength products (at least in the short term) to potentially increase their chances of quitting”

“However, the structure of the proposed duty will make it more expensive for smokers who do so.”

The following statements sum up the unwanted consequences of taxing e-liquids due to nicotine strengths…

“If the duty encourages ex-smokers who vape to stop vaping or to switch to lower-strength e-liquids, there is a risk it could trigger relapse to smoking”

“This seems unlikely for long-term ex-smokers who reported using the lowest nicotine strengths, which may reflect people ‘tapering down’ their nicotine use over time or having quit with and continued using older-generation refillable devices (which, as we found, are typically used with lower-strength e-liquids than modern disposables”

Also regarding the misperceptions of vaping vs smoking risks they state…

“There is also a risk that the duty could worsen misperceptions about the harms of vaping. Although we did not analyse perceptions in this study, recent data show smokers’ perceptions of the relative harms of e-cigarettes compared with cigarettes are as bad as they have ever been, with more than half believing they are equally or more harmful”

“Many people misattribute the cause of smoking-related disease to nicotine. Applying higher duty rates to higher-strength nicotine products may have the unwanted effect of worsening or maintaining these misperceptions if people think the tax is because the harms of these products are comparable to smoking rather than to reduce youth use.”

The economic issue is summed up as…

“If any of the potential responses outlined above are greater among disadvantaged groups, it could have a negative equity impact. E-cigarettes are an important intervention for reducing smoking-related inequalities, because they offer a less harmful way of using nicotine without the need to quit nicotine altogether, which can be appealing for people with difficult lives who are not ready to consider total nicotine abstinence. Vaping is also cheaper than smoking and price is a motivator for those on low incomes.”

“The UK government’s ‘Swap to Stop’ initiative to provide a million free e-cigarette starter packs (alongside behavioural support to quit) is focused on reducing inequalities. The Vaping Products Duty will need to be carefully communicated so as not to dissuade people who could benefit most from taking up the offer of a free e-cigarette starter pack from their local stop smoking service.”

And the final statement…

“In applying higher rates of tax to higher-strength nicotine e-liquids, the proposed Vaping Products Duty may be effective in reducing progression from experimentation to regular use and dependence among young adults (and potentially youth, who were not assessed here), including those who have never smoked. There may, however, be implications arising from the proposed duty for smokers trying to quit by vaping, which need taking into account before finalising the tax structure. Monitoring the outcomes and any unintended consequences from the policy will be important.”

Now published in @AddictionJrnl 🥳

Use of high-strength nicotine e-liquids in England appears to have increased sharply in recent years.

But taxing higher strengths at higher rates (as the govt proposes) could undermine quitting and perpetuate smoking.https://t.co/9gaAgaL4ur https://t.co/Qmwr7IWLoP

— Sarah Jackson (@DrSarahEJackson) June 20, 2024