Today in their Autumn budget the UK Government have announced their plans for a vape tax on e-liquid.

We have written about this before in proposals from the previous Conservative government of Rishi Sunak.

But today’s announcement is absolutely shocking!

The rates proposed are extortionate!

UK Vape Tax Details

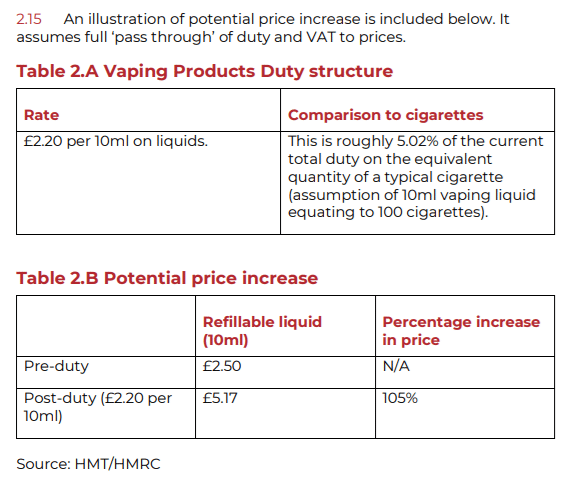

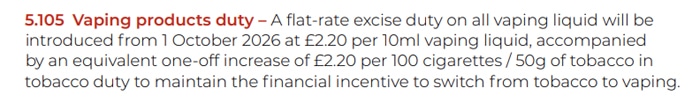

According to HM Treasury – a flat rate of £2.20 per 10ml of e-liquid will be applied from 1st October 2026.

This is all very murky to me as well. Does this tax only apply to e-liquid which contains nicotine? Would nicotine free bottles – such as shortfills – not be taxed? At present it would appear that all e-liquid is subject to this tax.

I asked around and the wonderful Martin Cullip pointed me towards the Vaping Products Duty Consultation Response published recently which breaks down the proposals in more detail.

“2.30 Vaping products will be considered ‘manufactured’ at the point the final product is made. In many cases this will be when vaping liquid has been composed from its ingredients. For example, for a typical liquid, once propylene glycol, vegetable glycerine, flavourings and, if relevant, nicotine are combined. This would be the point at which products are charged with duty. ”

“2.33 All vaping products will be within the scope of the duty including those produced at home from base ingredients, such as propylene glycol, vegetable glycerin, flavourings and nicotine.”

Plus to make things even more confusing there have been errors in some of the information released…

You really MUST clarify what these proposals actually are :- £2.20/ml OR £2.20 for 10ml

Whichever it’s still a woeful proposal that will cause much distress to ex-Smoking Vaping Adults who deserve much better than this ill-thought through #sintax https://t.co/e4kObMDo17 pic.twitter.com/HmnURdBUQM— Alan Beard (@Alan_Beard1) October 30, 2024

The Vaping Products Duty Consultation Response PDF (paragraph 1.4) states the tax will be £2.20 per ml of e-liquid rather than the £2.20 per 10ml in the official budget statement!

What Does This Mean For Vapers?

Firstly I will look at a 10ml bottle of e-liquid.

E-liquid containing nicotine can only be sold in 10ml or less quantities.

So a lot of people buy 10ml bottles usually of nicotine salt or similar e-liquid.

At present you can buy a bottle of this from around £2.99 upwards. With the tax applied this will means you will be paying over £5 for a 10ml bottle!

Even worse is when you buy larger quantities of e-liquid – such as shortfills.

For example – a typical 100ml shortfill bottle containing no nicotine retails around £9.99.

With the tax applied this will more than triple in price!!

£9.99 + £22.20 (vape tax – 10 x £2.20) = £36.39 including VAT.

That is beyond extortionate!

It Gets Worse…

Oh and also remember VAT at 20% will be added too!

Not to mention there will be extra expense for manufacturers to comply with new regulations so this could hike the price up further!

As a vaper who used vaping to quit smoking this feels like a punishment.

Oh and if you think the “Black Market” in vapes is bad now – wait until these new taxes kick in!

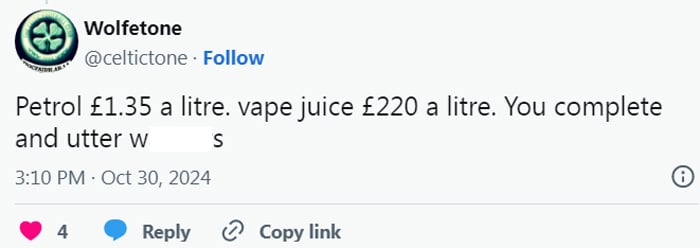

This tweet sums it up for me – e-liquid will be taxed higher than petrol!

Unfair

Unfair

When you see the statement in the budget about the application of tax to e-liquid and tobacco an obvious discrepancy appears…

So every 10ml of e-liquid is faced with an additional £2.20 of tax.

The government are trying to ensure that vaping remains cheaper than smoking as a further incentive to give up.

However is 10ml of e-liquid really equivalent to 100 cigarettes or 50g of tobacco? In theory – you could be using that 10ml of e-liquid at a faster rate than you would smoke the equivalent tobacco version?

Simply demonstrates that @hmtreasury haven’t a clue if they think 10ml ecig juice is equivalent to 100 cigarettes in any way shape and form….either in health or cost terms.

THIS doesn’t maintain the differential

Needs a far larger differential to maintain attractiveness— Alan Beard (@Alan_Beard1) October 30, 2024

Next Steps For Vape Retailers, Distributors & Manufacturers

The new tax to be applied to e-liquid will cause a big headache for vape retailers, distributors and manufacturers.

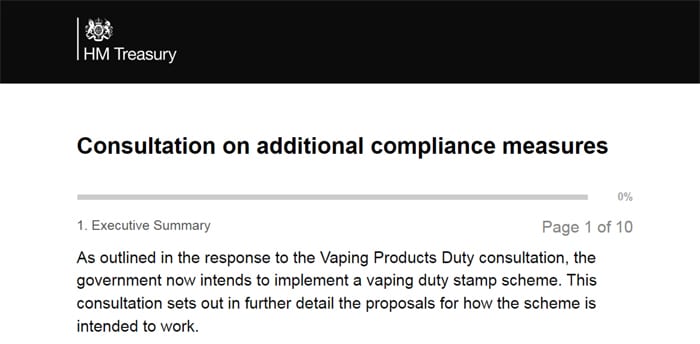

A system of “Stamps” is proposed where a seal is applied to products when the appropriate duty has been paid.

In order to configure the system, the UK Government has launched a technical consultation to assess the best way for this to be administered.

Make sure to get your voice heard and let them know all the implications the new regulations will have on your operations. Respond to the consultation here – closing date is 11th December 2024.

Responses

As you can imagine this has really caught the attention of the public, vaping industry associations, consumer organisations and vaping advocates. I will share some of the responses below and will be adding to these responses as statements are made!

As always please let us know your thoughts in the comments below!

New Nicotine Alliance (NNA)

Press Release

Press Release

The Chancellor’s new vape tax proposals are a misguided assault on quitting smoking.

Created: 31 October 2024

Yesterday, Chancellor of the Exchequer, Rachel Reeves, announced amendments to the vape duty which was originally proposed by Jeremy Hunt in the spring budget that preceded the general election.

The NNA wrote at the time that Hunt’s plans were “wrong in principle and childlike in application.” They seemed to be rushed, were based on flawed reasoning, and relied on a fundamental lack of understanding of how vaping works to reduce smoking rates.

It was to be hoped that a new government would take time to consider the problems that would arise as a result and study the subject more seriously. However, the new government appears to be as ill-informed as the last and likely swayed more by tabloid rhetoric than sober, evidence-based research. The new government promised change, but little has changed for the better.

On the plus side, the government has commendably abandoned the three-tier approach to taxation which would financially disadvantage higher strength liquids most used by people switching from combustible cigarettes. It instead proposes a flat rate of tax, but that is where the common sense ends.

Once again, we have a government which rightly continues to promote supplying one million free vapes to smokers, only to then disincentivise those who take up the offer by applying heavy duties to the liquids they need to actually use them.

As in the previous version of the vape duty, there is no appreciation of the vast difference in risk between combustible tobacco and vaping products. The government’s response to the vape duty consultation, which took place before the election, was published to coincide with the budget announcement and makes the same mistake as many commentators in seeing nicotine as the problem, rather than combustion.

It states that the duty will “further disincentivise young people and non-smokers … who may switch to refillable products in response to the ban [on disposables].” Single use vapes were supposedly banned because of their impact on the environment, hence why the legislation was added to the Environmental Protection Act. Those who supported the ban argued that it was not a burdensome imposition because vapers could use refillable devices instead, but it is now clear that the Labour government sees all vaping as undesirable.

It is highly naive to expect all users of disposable vapes to simply quit use of nicotine. To aspire to that goal is extremely irresponsible. The tax to be imposed means it is now far more likely that the chosen alternative following the disposables ban will be cigarettes rather than less environmentally friendly alternatives to single use products.

The government seems oblivious to NHS guidance that “nicotine itself does not cause cancer, lung disease, heart disease or stroke and has been used safely for many years in medicines to help people stop smoking.” Cigarette use is so dramatically more harmful than vaping that it is beyond belief that the government would flirt with the possibility of people returning to smoking, or seeking nicotine from combustion instead, by actively discouraging other vaping options.

Commenting on the previous vape tax regime, we criticised the irrelevant obsession with calculating the nicotine in vapes and comparing it with nicotine in cigarettes. It should be obvious that it is a pointless exercise when one product is vastly more harmful than the other, not due to nicotine content but because of the effects of combustion. The calculation in Jeremy Hunt’s supporting documentation at least had the merit of explaining the reason for setting differential vape duty for varying strengths of liquid, however flawed it was.

It is even less understandable now that the proposal is for a flat tax but has led to this extraordinary table in the HMRC documentation behind the duty announcement.

“Disposable vapes DO NOT contain as much or more nicotine as a packet of 20 cigarettes. Comparing like with like, a UK standard 2 ml disposable vape contains 40 mg of nicotine, an average pack of 20 cigarettes contains 250 mg of nicotine which is more than six times as much.”

The ASH explanation refers to a single use vape containing 20mg/ml of nicotine. Therefore, a 10ml bottle at the same strength would contain 200mg of nicotine, which is around 16 cigarettes, nowhere near 100. Using this mythical justification, the government has significantly over-estimated the threat of vaping and/or under-estimated the risks of smoking.

Consequently, the level of taxation proposed for vaping liquid is fatally flawed. The Chancellor announced that there would be an equivalent increase of £2.20 per 100 cigarettes in tobacco duty to “maintain the financial incentive to switch from tobacco to vaping”. It is nothing of the sort. The Chancellor has considerably reduced the financial differential between smoking and vaping

According to the the Office of National Statistics, the average price of a pack of 20 cigarettes is £15.88, meaning the tobacco duty increase is 44p per pack, or 2.77%. The government’s own estimation of the increase in cost for vape liquid is 105% before VAT is included, more than doubling the cost of quitting smoking. It is more alarming still when you consider that low-income vapers can currently buy bottles for £1 from some stores, which would increase by 264%.

This is without factoring in the large increase in costs for vape liquid manufacturers to cope with tax regulations which they have not encountered before. The new proposals involve registering with the government and buying tax stamps to prove products have complied with regulations, at their own cost, which will surely raise retail prices before tax. It is worth noting that even cigarettes do not have to apply tax stamps in the UK.

As we explained in March, the only result of this will be a significant deterrent to smokers who are considering switching to vaping, an increase in sales of illicit products, and relapse by many back to smoking cigarettes.

This misguided attack on quitting smoking means only one thing, that the government’s Smokefree 2030 target is now nothing but a pipe dream.

We Vape

“This is a tax on people choosing a vastly safer way of consuming nicotine. Where this has been introduced elsewhere, taxes on vaping have increased smoking rates. It will push some of the poorest people in society into poverty simply because they enjoy nicotine, which carries no more health risk than a cup of coffee or tea.”

UKVIA

Press Release

Press Release

UKVIA Statement on New Vaping Products Duty Announcement

John Dunne, Director General of the UK Vaping Industry Association (UKVIA), said of today’s Vaping Products Duty that will be introduced from 2026:

“Whilst a flat rate tax versus one graded on different nicotine strengths is favoured so as not to deter smokers who rely on higher concentrations of nicotine when they start transitioning over to vapes, the additional cost of £2.64 (including VAT) per 10mls of e-liquid is a kick in the teeth for former adult smokers who have switched to vaping to quit their habits. It will also be the highest rate in Europe.

“Some 3m adults are former smokers thanks to vaping, which is strongly evidenced as the most effective way to quit conventional cigarettes, saving the NHS millions of pounds in treating patients with smoking related conditions. This announcement today deters adult smokers from considering vapes as a method to give up their habits, and hits the lowest paid who go for more price sensitive e-liquid options, which currently start at 99p and will rise to £3.83, representing a shocking rise of 267%.

“For a Government that places a great focus on the NHS, it is a nonsensical move to put a severe punitive tax level on vaping when the category has done so much to reduce the number of adult smokers requiring medical attention by being a driving force in the decline of smoking rates to record low levels in recent years.

“Today’s announcement is effectively a revenue grab from former smokers and penalising them for making considerably less harmful choices. It would also make more sense for vapes to be taxed at a lower VAT rate, which is the case for other Nicotine Replacement Therapies, which have proven to be considerably less successful than vapes in helping smokers quit.

“We will be responding to the Vaping Products Duty Consultation that sets out the proposals for how the duty will be designed and implemented.”

IBVTA

Press Release

Press Release

Vape industry responds to Chancellor’s budget announcement on vape excise.

The Independent British Vape Trade Association (IBVTA), the leading independent trade association for the UK vaping industry, acknowledges the change in structure of the excise first mooted by the previous Government. However, it reiterates concerns of unintended consequences.

As part of her first budget, Chancellor Rachel Reeves has announced a flat rate of excise duty on vaping liquids at a rate of £2.20 per ten millilitres, from October 1st 2026.

This would mean the cost of the products used by many thousands of vapers including those on lower incomes, 10ml refill bottles, will increase by £2.20 +VAT and the rate of a 2ml pre-filled pod will increase by £0.44+VAT.

The previous Government had announced a tiered structure, meaning a higher rate of excise would have been applied to the products which smokers need most to make a successful switch, and had been warned against by public health academics and organisations, including Smoking on Action and Health (ASH).

The Government has also announced a technical consultation on additional compliance measures which sets out proposals for vaping duty stamps and seeks views on options to limit illicit production of vaping liquids by placing controls on the supply chain of nicotine. The consultation will run until 11th December 2024.

Welcoming the change of policy from the previous government’s tiered proposed structure, Independent British Vape Trade Association (IBVTA) Chair, Marcus Saxton, said:

“The government has already proposed regulation that will ban single use products, which despite helping many adult smokers access vaping, have via irresponsible retailers been disproportionately accessible to children.

It would seem a little questionable then to increase the cost of vaping, especially given there are still around six million adult smokers for who you’re trying to give every opportunity to make the transition to less harmful products.

There’s also the potential negative effect of an excise on public services utilising vapes within their smoking cessation services. The IBVTA do not believe that any excise tax should be applied to products supplied via these services.

The IBVTA will continue working constructively with HMRC to make sure these proposals are meaningfully enforceable and don’t have unintended consequences.”

Social Media

The Government will heavily tax quitting smoking by switching to vaping. So much for the promise to reduce the burden on the NHS and to prevent, not treat, ill health.

It may not work as intended: criminal networks will expand to supply unregulated, untaxed products to anyone. https://t.co/FF1ZeUJEyE

— Clive Bates (@Clive_Bates) October 30, 2024

The UK Government is insane if it thinks imposing a 220% tax on a £1.00 bottle of eliquid isn’t going to drive ex-smokers back to smoking.

— Dave Cross (@_Dave_Cross_) October 30, 2024

The rationale is flawed, what about existing adult Vapers who switched from 🚬?

What do you think will happen here?

1)Move to the black market?

2)Return to 🚬?

3) Simply Quit ?

#3 unlikely, #1+2 very likely to happen #SinTax #PissPoorPolicy without proper investigation!!— Alan Beard (@Alan_Beard1) October 30, 2024

Sorry, the black markets calling 📞

— Hames (@jameslfc89) October 30, 2024

£2.22 for 10ml would add an extra £22.20 onto the price of a 100ml shortfill. That is insane. They’ll triple in price!

— Fewgee1 (@KoKane_96) October 30, 2024

Petrol £1.35 a litre. vape juice £220 a litre. You complete and utter wankers

— Wolfetone (@celtictone) October 30, 2024

Give up smoking they said. Costing us out of it. Do some of us have successfully given up smoking by vaping.

How about you crack down on those selling it to kids rather than tax us adults who are trying?— The Original Pagan (@TamsynSimmons3) October 30, 2024

I currently buy 3 x 50ml Nicotine free shortfills for £25. As of Oct. ’26 it seems these will cost £25 + another £33 in Tax totalling £58! That’s a ridiculous increase. Can I sign something to say I’m an old ex-smoker who has vaped for years to avoid this extortionate tax please?

— Seculatheist (@seculatheist) October 30, 2024

The tiered model was beyond stupid.

A 50% sin tax runs it a close second.

Tobacco harm reduction only works if the alternative is attractive. https://t.co/jAWJEuVZyQ

— Dave Cross (@_Dave_Cross_) October 30, 2024

Taxing vaping is supporting smoking. https://t.co/2qNHDJkLYw

— Mark Oates (@MOates_) October 30, 2024

As @NannyFreeState & I discussed last week, TC and government want people to not smoke, they just didn’t want to see the rapid deceleration that has happened.

And here ya go. We don’t want you to vape, we want you to smoke! https://t.co/cNy1EWGWH8

— Lindsey Stroud (@lmstroud89) October 30, 2024

The government acts swiftly to tackle the decline in cigarette sales by adding a whopping tax on the most popular and effective means of quitting smoking which caused it. #GoodGrief https://t.co/2qhrnbCVWI

— Martin C (@NannyFreeState) October 30, 2024

For a finished vape product, that makes sense, but shortfills are not currently covered by the TRPR because they are not a finish vape product. Be interesting to see what they do about those, if the tax does apply to shortfills, 90% of the market will be wiped out overnight.

— Max (@dansus) October 30, 2024

“But while this will make vaping less affordable for kids, it will also have the same impact for smokers” – and the 3m ex-smoking vapers? pic.twitter.com/75vp1oVzQM

— Geoff Vann (@BV_dodderer) October 30, 2024

“We want people to take up smoking again, so we’ll make vaping more expensive…”

— Paul Herring (@xas7wcrg9e) October 30, 2024

🔥UK’S New #Vape Tax! I would love to get your hot take 👇

Here’s mine pic.twitter.com/uj03zMlOzl

— GrimmGreen (@GrimmGreen) October 30, 2024

Please tell your MP how the Vape tax will effect your finances using the form on our website: https://t.co/5AyEJvqMbU

For reference we believe a £10 100ml bottle will go from around £9.99 to £36.39.

This is an awful, vindictive policy, which will hurt the poorest the most.

— We Vape (@WeVapeUK) October 30, 2024

Let me get this straight. Implementing a tax on a product that is significantly less harmful than cigarettes, helps many adults quit smoking & offered for free under the “Swap to Stop” initiative to discourage the youth that are already protected under the age restriction laws. https://t.co/sDaUME4l4C

— Kurt Yeo (@Kurt_Yeo) October 31, 2024

Unfair

Unfair

Press Release

Press Release Press Release

Press Release Press Release

Press Release